Having no business plan

Business plans evaluate the market for your product or service and the competition you’ll face. The plan examines how much money you’ll need to start and run your business, as well as what kind of income you can expect.

You might discover that your great business idea isn’t so bright after all when you put together a business plan. As a result, small business owners often jump right in with no plan and wonder why things don’t work out as planned. In the case of cannabis, the industry is littered with huge success stories and dramatic failures. Growers, manufacturers, processors, dispensaries, nurseries, consumption lounges, testing labs, are not exempt and each presents its own particular challenges.Â

Having a well thought out business plan can help illustrate early on the benefits and potential pitfalls that all startups face throughout the lifecycle. If you don’t know your numbers you don’t know your business.

Lack of a marketing plan

Business plans and marketing plans go hand-in-hand. Your business can’t make any money if nobody knows about it. A marketing plan will help identify your ideal customer and figure out how to appeal to them and differentiate yourself from your competitors. Â It is also important to establish ways to measure your success so that if something doesn’t work, you can change course.

With the challenges that cannabis businesses face with online advertising restrictions, a focus on content, email, social, and experiential marketing is a must. In order to generate organic traffic, you should create original content such as storytelling, educational, and statistical content and work with a qualified link building company. To capture your web traffic incorporate email capture software to allow you to retarget previous visitors with email updates.Â

When using social media one has to be careful using hashtags that have been flagged and using images that are too explicit. Last but not least, creating memorable events coupled with cool and practical merchandise goes a long way when it comes to customer loyalty.Â

In the absence of a marketing plan, you’ll likely waste money and time on a hit or miss approach.

Haste makes waste

Your new business won’t be built in a day either. In the first year or two, most small businesses are not profitable, and setbacks are common after some initial success. A successful business owner has the patience and financial reserves to keep pushing forward. Refrain from purchasing big ticket items thinking that one big thing will catapult you into stardom. No t-shirt design, no machine, no great deal on some killer flower will help you bring awareness and sales to your brand overnight. If you have no customers, you run the risk of sitting on a boat load of merchandise that will either go bad or get dated because it hasn’t sold in months.

Squandering Resources

Keeping costs under control is one of the biggest problems facing small business owners. Until your business has shown consistent profits, it pays to be conservative in your spending. A large or expensive office space, nonessential employees, or equipment that is more or fancier than you need can break your budget. Debt shouldn’t be taken on lightly. If your business fails, you will still be responsible for paying those debts as a new business owner. You might have to sign a personal guarantee if you borrow money.

Undervaluing

Underpricing your products, services, and your company valuation as a whole can lead to loss of money despite your hard work or giving up too much equity when you decide to raise money with investors.

A new business will often do this for various reasons: either they want more business by undercutting their competitors, or they simply don’t know what they should charge. Unless you charge enough, you might not even be able to cover your overhead costs. When negotiating with investors remember money is the cheapest commodity. Don’t forget the hours, weeks, months, and years you put into your business is your sweat equity which has a monetary value. Calculate those hours and price that into the worth of your brand and business aside from money spent on marketing, merchandise, and equipment.

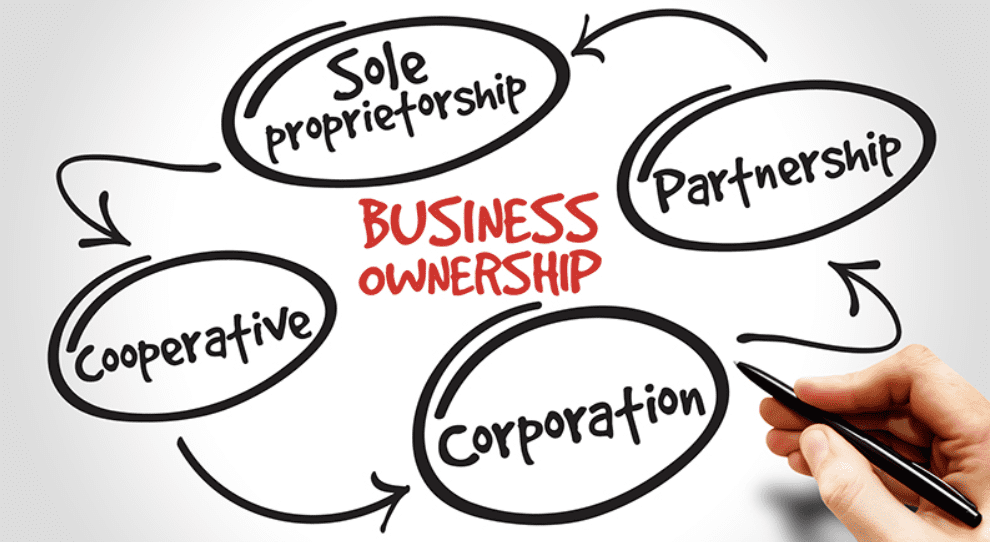

Not Forming the Right Business Entity

It is common for new business owners to delay setting up their business entity in their rush to get up and running. Alternatively, they form a limited liability company because their friend suggested it.

It’s possible to have serious consequences down the road if you choose the wrong business entity-or don’t have one at all. A general partnership, for instance, may surprise you by holding you personally liable for all the company’s debts – even those you didn’t agree to. In a corporation, you are taxed on both a corporate and personal level, so you may end up paying higher taxes.

Make sure you structure your business in a way that will save you money and help you avoid liability by doing your research and consulting with legal or financial professionals.

Insurance Is Not Necessary

In the event that someone slips and falls on your premises, has an accident with a company car, or is sued for defective products, malpractice, or any other personal wrongdoing, setting up a business entity limits your personal liability for business obligations.

Both your business and your personal finances can be destroyed by these kinds of claims. Make sure you have enough insurance coverage by consulting an insurance agent. One may be surprised how affordable insurance can be considering a simple accident can result in an overwhelming lawsuit.

Business Partners Without Written Agreements

Any business needs a written document that describes each partner’s rights and responsibilities and what will happen if one of them leaves the company. This can be accomplished with a partnership agreement, an LLC operating agreement, corporate bylaws, or a buy-sell agreement, each serving slightly different purposes. Unfortunately, business partners are often unwilling to put things in writing because they get along well with each other and think they can always resolve things informally.

Without this specific formality, your LLC can closely resemble a sole proprietorship or partnership, jeopardizing your personal liability.

The operating agreement, for example, outlines the financial and functional decisions of an LLC, including its rules, regulations, and provisions. It is designed to govern the internal operations of the business according to the owners’ specific needs. By signing the document, the members of the limited liability company are bound by its terms.

Contrary to popular belief, disputes between partners can be costly, emotionally draining, and difficult. There’s a famous saying, success has a hundred fathers, failure is an orphan. Nothing worse than dividing money between partners with no agreement in place especially when everyone wants to take credit for a particular accomplishment.

Failure to protect intellectual property

You may be eligible for copyright, patent, or trademark protection if you produce artwork, music, software, or inventions. Additionally, you may be able to protect your business name and logo as trademarks under state and/or federal laws. In order to protect their intellectual property, smart business owners register it with government agencies and actively monitor competitors’ use of their proprietary information.

Thinking You Can Do It All Yourself

It is important for entrepreneurs to learn to delegate tasks and understand their limits if they are going to succeed in their startup. Find others who can handle tasks that you dislike or that require specialized knowledge, and concentrate on what you excel at.

There is nothing more exciting than starting a business, but don’t rush yourself into it. To ensure your business’s success, plan ahead and protect yourself. Let your business grow slowly and patiently.